The Federal Student Aid Account (FSA) ID is a username and password which allows both students and contributor(s) to log into the FASFA each year and access other federal student aid-related sites, such as StudentAid.gov external website. It can serve as your legal signature on federal student aid platforms.

Each student and their contributor(s) require a separate FSA ID.

Determining Contributor(s)

A student's dependency status determines whose information they must report when filing the FAFSA.

If you’re a dependent student, you will report your and your parents’ information.

If you’re an independent student, you will report your own information (and, if you’re married, your spouse’s).

A dependent student is assumed to have the support of parents, so the parents’ information must be assessed along with the student’s to get a full picture of the family’s financial resources. If you’re a dependent student, it doesn’t mean your parents are required to pay anything toward your education; this information is simply used to determine the student’s maximum eligibility for federal student aid.

A student's dependency status and required contributor(s) will also be determined when the student files their FAFSA.

If a student is considered dependent for FAFSA purposes, the student must provide information about their legal parent(s) on the application. This may include the student's biological or adoptive parent (including step-parent).

In the case of parental divorce or separation, the parent who provides the greater portion of the student's financial support will be the contributor and create an FSA ID. Please note: If that parent is re-married, the step-parent would also be included on the student's FAFSA.

A contributor is required to provide their information, but participation does not indicate any financial responsibility. Without the required parental contributor(s) submission, the student is ineligible for federal student aid.

Do Both parents (including step-parent) need an FSA ID?

One parent contributor will be required to create an FSA ID unless:

- Parents are married and filed separate, head of household, and/or single

- Parents were recently married

- There may be other exemptions based on tax filing

In any of the above scenarios, both parents would be a contributor and each parent would create their own personal FSA ID.

If the student is independent and not married, no contributor is required. Only the student will need an FSA ID.

If the student is married and filed taxes jointly, only the student will need an FSA ID.

If the student is married and filed taxes separately or did not file taxes, the student's spouse will be a contributor and both the student and spouse will need an FSA ID.

A contributor is required to provide their information, but participation does not indicate any financial responsibility. Without the required contributor submission, the student is ineligible for federal student aid.

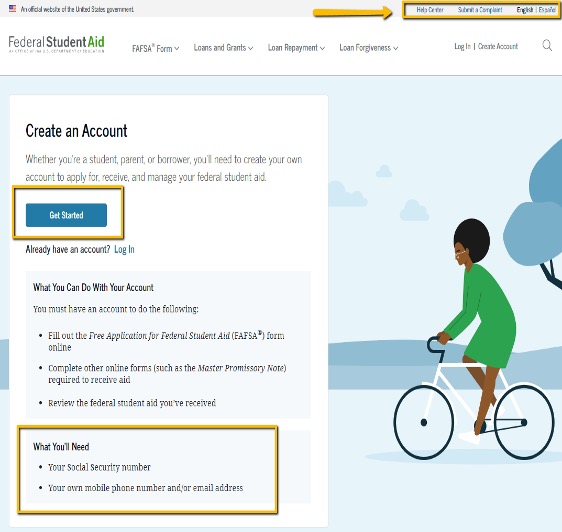

Creating Your FSA ID

- Select: Get Started

- Note Resources in upper right

Remember: Each student and contributor completes their own personal FSA ID.

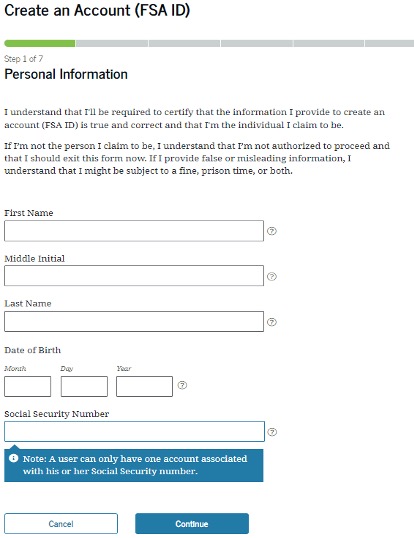

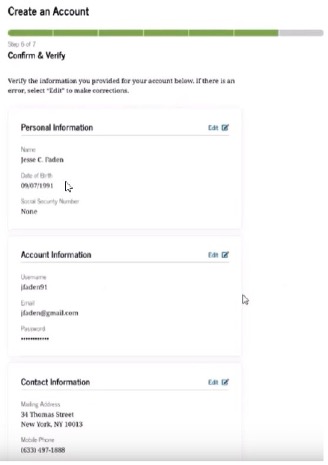

- Enter Personal Information

- Enter SSN

- Students must be a U.S. citizen or eligible non-citizen to be eligible to apply for federal student aid.

- Beginning end of Dec 2023, contributors without a SSN can still obtain an FSA ID with additional setup steps.

- Create a username, enter your personal email, and create a password

- You’ll be notified if your selected username already exists

- A student and contributor cannot use the same email

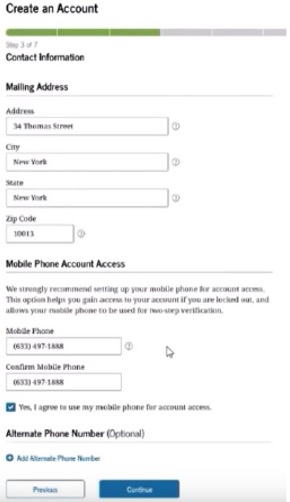

- Enter mailing address and phone number(s)

- Mobile is recommended for account recovery; mobile numbers should not be the same for student and contributor(s)

- Confirm communication and language preferences.

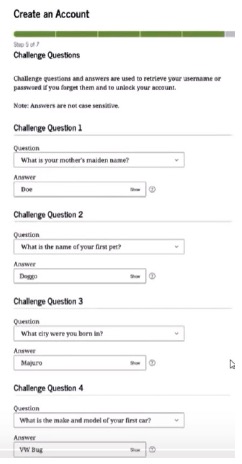

- Provide four (4) challenge questions and answers

- Review your personal information for accuracy

- Confirm and verify your personal information

- Acknowledge the terms and conditions

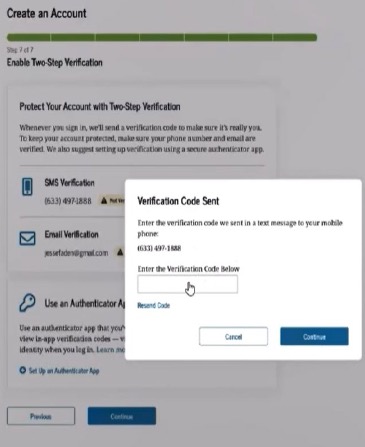

- Enable two-step verification to safeguard your account

- Can be verified via email and mobile

- After set up, a green box and check mark will appear, confirming your Two-Step Verification

- Authenticator App (optional)

- Provides most security of the FSA ID two-step verification methods

- Follow the Set up Your Authenticator App with instructions

- Backup Code will be generated

- Store this code in a secure place, along with your username and password

- Will be used should you not be able to use your two-step verification method(s)